Prof. Jeffrey Sachs, Director of the Center for Sustainable Development at Columbia University, wrote in The Boston Globe on 9 March 2020 that students have had it right all along on divestment and climate disruption, while university trustees and administrators have failed to be realistic.

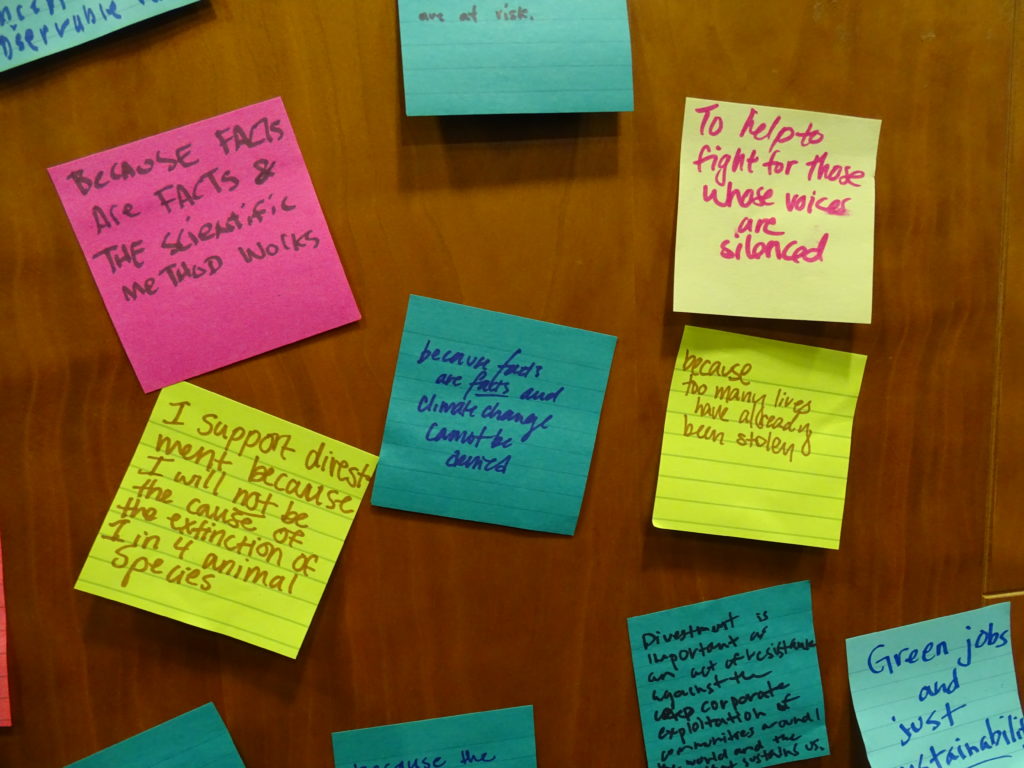

Since the US fossil-fuel divestment movement started in earnest in November 2012, with the launch of Go Fossil Free by the climate group 350.org, universities have considered whether to divest fossil fuels from their endowments. Students have pushed university administrators to divest, while administrators have pushed back, lecturing students about the “real world” of sound investing and the purported need to keep fossil fuels in the endowments. Eight years on, the lessons are clear. The students are the ones living in the real world, while university administrators, trustees, and endowment managers have been living in an energy fantasyland.

The divestment movement was launched because it was clear to climate scientists that the three fossil fuels — oil, coal, and gas — would have to be phased out and replaced by renewable energy sources, such as wind and solar power, in order to avoid catastrophic climate change. The shift from carbon-based fossil fuels to renewable energy is known as decarbonization. We are in no danger of running out of fossil fuels, but relying on them, as many reports have warned, is dangerous. In order to pursue a safe path to decarbonization by 2050, those reports demonstrate a significant share of the fossil fuel reserves as of 2012 would have to be “stranded,” or left underground.

The implications were clear enough to close observers. Major oil, gas, and coal companies that were touting new multibillion-dollar exploration and development projects, including the fracking of unconventional oil and gas, were on the wrong track, squandering shareholder wealth by developing new reserves that would never be used. Share prices would eventually be marked down. Industry forecasts of decades of rising fossil fuel use would prove wrong.

The fossil-fuel industry was therefore already a bad bet in 2012, except to industry lobbyists and to money managers looking backward rather than forward. The US fossil-fuel industry perhaps came to believe its own hype, that with enough lobbying clout there would be smooth sailing in the years ahead. Yet despite President Trump’s pro-fossil-fuel policies, and his withdrawal of the United States from the Paris climate accord, most governments around the world, and indeed most state governments in the United States, are sticking with the Paris accord and are cutting back on fossil fuels and shifting to renewable energy.

If more university administrators had understood these facts earlier, they would have listened to their students, not their money managers or their donors. They might have recognized that well-heeled donors linked to the fossil-fuel industry who opposed divestment were not necessarily promoting the interests of the university over the fossil-fuel companies.

Read the whole article on The Boston Globe site.